On the occasion of the Lagos Court of Arbitration (“LCA”) First International ADR Summit, Sophie Nappert and Hafez Virjee were invited to deliver a Masterclass on “The future of arbitration in technology”, which took place on 17 September 2019. Hafez’s contribution focused on blockchains and smart contracts. The following post has been adapted from his original presentation, while keeping some of the conversational style, and a few references have been added for clarity and/or to explore the topic further. [1]

.

For starters, how relevant is blockchain to international arbitration? It’s potentially a source of new disputes. It might also become a medium in the resolution of disputes, especially those arising from smart contracts. Evidence recorded on a blockchain can’t be tampered with. A blockchain could also serve as a central repository of awards and may facilitate recognition and enforcement efforts. There’s enough here to make it worth it to take a closer look.

But what's with the jargon! There is a whole vocabulary around blockchain and smart contracts. Which are the words you are less comfortable with?

What is…

Block

Mining

Hash

Timestamped

Node

P2P

Distributed ledger

Cryptos / cryptocurrencies

Bitcoin and Ether

Public and private keys

Digital signature

Oracle

ICO

Characteristics?

Decentralised

Disintermediated

Secure

Immutable

Trust

Transparency

Private / confidential

Self-executing

Let’s clarify the meaning of these terms. They are bolded in blue in the text below for ease of reference.

***

Blockchain is often confused with its applied use for cryptocurrencies such as Bitcoin, but really it is only the underlying technology, like the electrical cables that are used to power the lighting in this room, as opposed to the light itself.

As its name indicates, it’s a chain of blocks. Each block contains a set of data, and the blocks are linked between them, as if they were on a chain.

A blockchain doesn’t come ready-made. It’s a bit like a chain of daisies. You need to find the first daisy, [2] then find a second daisy, then chain the second one to the first one, then find the third daisy, and chain it to the second one, and so on.

In blockchain technology, you ‘mine’ or ‘forge’ the block rather than find it. [3] The ‘mining’ terminology is due to the fact that it requires a lot of computing power to create a block, more than the computers you and I typically use. And given the amount of computing power involved, electricity costs are a serious consideration too. For each Bitcoin transaction, this can involve as much electricity as an average Dutch household consumes in two weeks. [4] For this reason, some of the largest mines are found in places where electricity is cheaper, such as in China or Venezuela. [5] Since 2008, other, more sustainable alternatives to mining have been devised, [6] but we will focus for now on mining as it is the approach used for Bitcoins and many other cryptocurrencies.

So, why do you need so much computing power? To create a new block, the blockchain generates a mathematical problem that is complex to solve, but easy to verify.

A simple example at our level is prime factorisation. [7] A prime number is one that can only be divided by the number one and itself. 2, 3, 5, 7, 11 are all prime numbers; 6 is not, as it can be divided by 2 and 3. 2 times 3 is the prime factorisation of 6.

What is

the prime factorisation of

497,044,581,715,228,021

?

For us with a pencil and paper, it would take tremendous effort to find the prime factors of this number by trial and error – if we ever do!

694,947,839

x

715,225,739

=

497,044,581,715,228,021

694,947,839 and 715,225,739 are both prime numbers, as you can confirm easily with an online prime number calculator. [8] The product of 694,947,839 and 715,225,739 is 497,044,581,715,228,021.

Once we had the solution, verifying it wasn’t too difficult to do. [9] In blockchain mining, the mathematical problems are a lot harder, and miners will need to devote considerable computing power to solve them. The other computers in the network will then verify the solution. Once the solution has been validated, the block is created and added to the chain, and the miner gets a reward for it. We will discuss the reward part later on.

The miners and the computers that verify the solutions are all nodes in the blockchain network. The nodes also store a copy of all or part of the blockchain. [10]

When a block is created, the data within it is encrypted. This helps to ensure that the data cannot be tampered with. The encryption is done, notably, by reducing all of the data to a ‘hash’, using cryptography. For the Bitcoin blockchain, that will be a string of 64 letters and numbers. [11]

It doesn’t matter that the original data to be encrypted was a short “I love you” or the full collected works of Chimamanda Ngozi Adichie, the hash will always be 64 characters.

To take this a step further, let’s say that you are encrypting the word “arbitration”. You can write it as "arbitration" (all in small letters) or as "Arbitration" (capital ‘a’ at the start of the word). From our point of view as practitioners, it’s essentially the same thing.

From an encryption point of view, however, that’s two completely different sets of data, and you will get two very different strings of 64 characters that don’t follow from each other.

arbitration

e49f5710c8d3e66821f0e0ee1c3ed574df3f0b48e2a65c4c357b654fa10ef402

Arbitration

6356dcb8669d976025526a3712cc6a80bc133ebc9b27eebd7173ddd74025950d

Because of all this, even if you have a supercomputer, you won’t be able to find back the original data by trying to reverse engineer the hash.

Back to our chain! When a block is created, it is not only its own data that is converted into the hash, but also the hash for the preceding block. In other words, each block contains within it an indirect record of the entire chain before it; plus, each block is timestamped. As a result, by looking at a given block, you can tell exactly what is its position in the chain, and this helps to ensure the integrity of the entire chain.

Now let’s say someone wants to change the data in one of the middle blocks of a blockchain without anyone noticing.

The thing about the blockchain is that, once a block has been created, you cannot modify its contents, as you will never get the same hash, and if you don’t have the same hash, then it won’t fit into the chain anymore since all of the blocks after it have a record of the original hash. It’s like trying to add a blue petal to a daisy: the change would be staring you in the face.

So, instead, maybe you’ll try and add a new block – like adding a new daisy to the chain. The result is a fork. [12] You have your main blockchain and then, somewhere in the middle, you have a new block dangling off. It will have all of the hashes of the preceding blocks, but it won’t be linked to the following blocks. If you try and bypass the block you wanted to change and connect the new block to the rest of the chain, the problem you will face is that the following blocks won’t recognise the hash of the new block. They all have within them the information from the full chain of blocks before them, including the one you are trying to bypass. So, your new block is just a loose dangling blue daisy that everyone will ignore as not belonging to the chain, especially as they all have a copy of the blockchain that doesn’t include your blue daisy.

Our discussion so far points to some of the key characteristics of a blockchain.

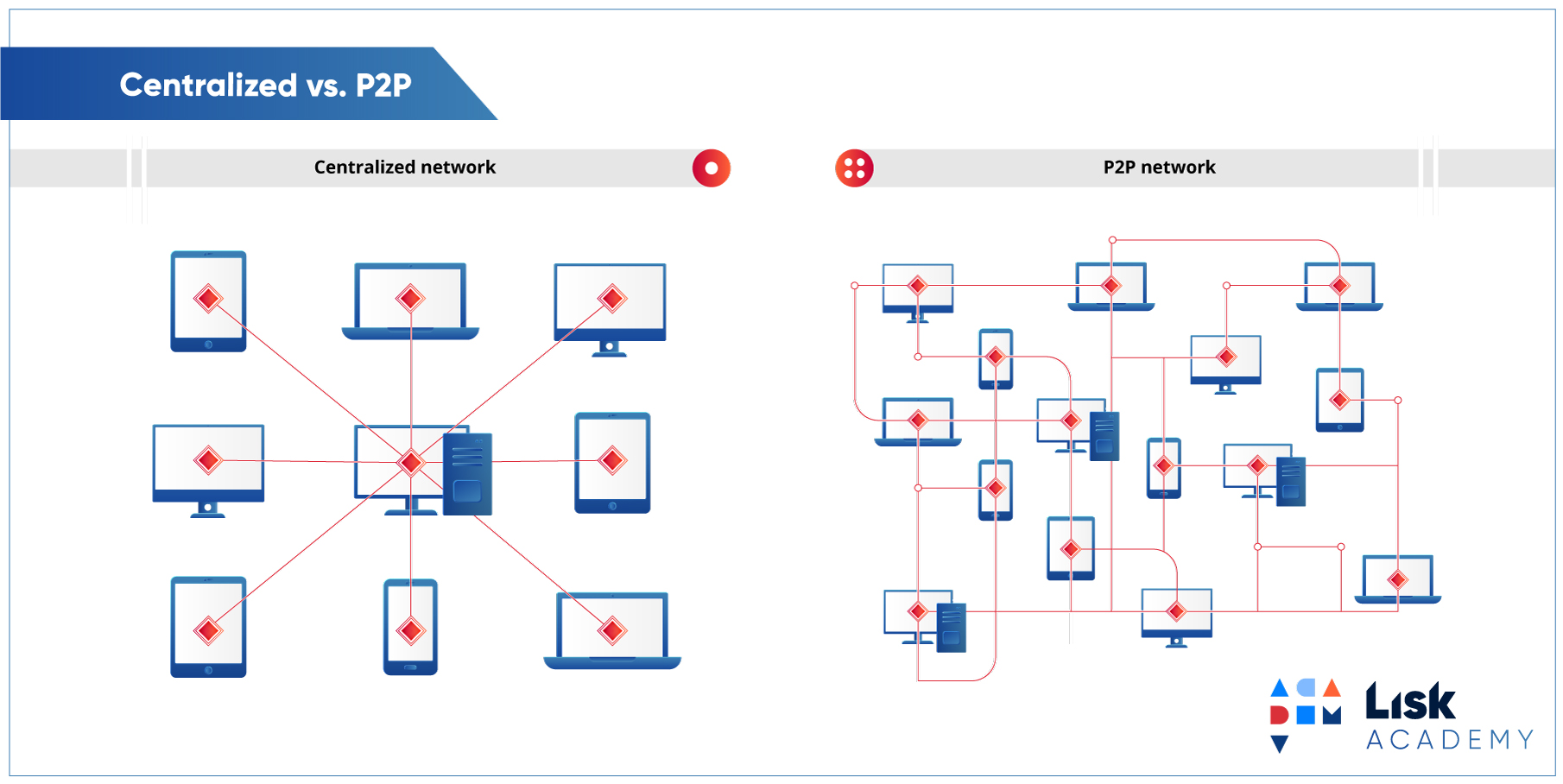

It is decentralised and disintermediated, that is, there are no intermediaries. As we saw, it is not a central authority but the other nodes in the blockchain network that validate each new block.

Each node also holds a copy of the blockchain, as it continues getting updated. A node can also be called a peer. What we have, then, is a network that is being managed by all of the peers in the network, without the need for a central authority. Or to put it differently, you would say that blockchains are managed autonomously using a peer-to-peer network. This is abbreviated as P2P. [13]

Blockchains are also described as distributed ledgers. They are ledgers in that they contain information, and they are distributed in that everyone who is involved holds a copy of the entire chain, including all of the new blocks that are being added to it. Even if one person’s computer got damaged or lost, this has no impact on the blockchain as you have a whole network of computers that have a copy of it.

Furthermore, because everything is encrypted, the data on a blockchain is considered to be secure.

Finally, a blockchain is immutable. Once data has been stored in a block, it cannot be changed; once a block is part of a chain, it cannot be ignored or bypassed.

Ok, so blockchain sounds like an interesting technology. But it requires a lot of investment to achieve the required computing power and to pay for electricity. Why bother, especially if it is to record other people’s transactions?

This is where cryptocurrencies come in. Blockchain was invented in 2008 by a person or group of people using the name Satoshi Nakamoto. The invention wasn’t so much all of the individual technologies rather than bringing them together to make a blockchain. Nakamoto invented the blockchain to support the establishment of an electronic currency based on cryptographic technology, known as Bitcoin. The goal was to create a new form of money that did not depend on banks or involve all of the costs associated with the banking system, such as paying extra fees when you are using your credit cards to make payments abroad.

There are multiple cryptocurrencies out there. Besides Bitcoin, the best known are Ether, Ripple, Litecoin and Bitcoin Cash. Part of what distinguishes these cryptocurrencies is how long it takes to record each transaction, i.e. how long it takes to mine a new block. The more time it takes, the more mining work is involved, so the higher the cost of recording the transaction. It takes about 14-15 seconds to mine a new block on the Ether blockchain, versus 10 minutes today for the Bitcoin blockchain. [14] Miners are rewarded for creating blocks by getting paid newly issued cryptocurrencies and, on some blockchains, transaction fees as well. [15]

***

We have discussed a number of features and technical aspects of blockchains, let’s now work through some examples. The female characters in the following illustrations all carry traditional, popular Nigerian names (another way of promoting diversity!): Kemi; Similoluwa, which can be shortened to Simi; Titilope, which can be shortened to Titi; and Morenikeji, which can be shortened to Moreni.

Our first two characters are Simi and Moreni. Let’s say Simi has just come into some crypto money. She had a tech client and accepted to be paid in Bitcoins. She now would like to spend some of these Bitcoins by buying this handbag from Moreni:

Photo by Alex Holyoake on Unsplash

Moreni agrees to sell her handbag and be paid in Bitcoins. They agree on a price.

The way we usually do things is that Simi will either then give Moreni the corresponding cash, or will make a wire transfer payment to Moreni. Let’s focus for a moment on wire transfers through internet banking:

- Simi will log on to her internet banking, enter Moreni as a beneficiary, type the amount she wants to send and then click confirm.

- Simi’s bank will then get in touch with B’s bank to check that B holds the designated account with that bank, and then send the money to B’s bank – at which point A’s account gets debited.

- Once Moreni’s bank has received the money, it will deposit the money on Moreni’s bank account, at which point that account will show a credit.

Now let’s say we were to use Bitcoins instead. Simi would click ‘make payment’ in her digital wallet, at which point that payment information will be recorded in a new block which confirms that Simi’s digital wallet should be debited and Moreni’s digital wallet credited as a result, and Moreni’s digital wallet will receive the money. No more banks. No more intermediaries. Less cost. The reason why this works is because of all of the characteristics of the blockchain we discussed earlier. These characteristics mean that you can interact with anyone without the need to rely on a trusted intermediary such as a bank.

To come back to our example, Moreni then of course gives Simi the handbag.

Let’s say that, at that point, Moreni decides to throw in a keyring. As we saw, it will not be possible for Simi and Moreni to modify the block to change the description of the transaction to reflect the fact that, for the same price, Moreni also handed over a keyring. Instead, if they want a record of this, Simi and Moreni will have to enter a new transaction, which will be recorded as a new block.

Now, say Kemi likes Simi’s new handbag and wants to find out where Simi got it from. Kemi knows that Simi has started using both Bitcoins and Ethers, so Kemi looks at both the Bitcoin and Ether blockchains. What does Kemi see? Kemi can see that many transactions are taking place on the blockchains. Kemi can also see how many Bitcoins each user holds. If you have no more banks or central bank, then you need some transparency to compensate. But other than that, Kemi will see nothing of interest for her purposes: Kemi cannot find out what Simi paid or who Simi paid it to or what Simi made a payment for, or even if Simi actually used Bitcoin or Ether as opposed to Naira (the local currency in Nigeria) or Euros.

As we saw earlier, the blockchain records transactions, but does so in an encrypted manner. When Simi bought the handbag from Moreni, the relevant information was the identity of Simi and Moreni, the object of the transaction, its amount and who was paying who. All of this information was encrypted, and you need keys to decipher it.

Simi, Moreni, and everyone who uses the blockchain each has two keys: a public key and a private key. The two are distinct from each other, so it is not possible to deduct what one key is from knowing the other. The public key is like an e-mail address or a letterbox. When Simi bought the handbag from Moreni, Moreni gave Simi her public key so that Simi knew where to send the money. And Moreni could access the money thanks to her private key. Now remember, this is a peer-to-peer network. So if Moreni loses her private key, there is no central authority Moreni can go to, to have her private key reset. It’s not like an e-mail account where you can reset your password, using security questions. If the private key is lost, then all of the data controlled by that private key is lost. [16]

In sum, without knowing Simi’s public key, Kemi will not be able to identify the transactions made by Simi, let alone that the transaction was with Moreni. And even if Kemi had Simi’s public key, without Simi’s private key, she will not be able to make head or tail of Simi’s transactions. Plus, Simi may have several accounts, and therefore several public keys.

In other words, a blockchain can be used to keep information private. But this also means that a cryptocurrency blockchain can be misused for illicit financial transactions. Because a cryptocurrency blockchain is disintermediated, there are no banks to check on the source and destination of funds. And because a cryptocurrency blockchain is decentralised, regulation is particularly difficult.

I’ll add a wrinkle here. Let’s say two IA practitioners, G and T, are using the Bitcoin blockchain to engage in an illicit trade of OGEMID brownies. G needs to be absolutely certain that when it is sending the Bitcoins to T, it is indeed T receiving them and not an OGEMID moderator trying to catch G red-handed. In a traditional banking system, the question doesn’t arise as all of our identities are controlled by our banks with increasingly onerous KYC requirements. But what do you do in a completely decentralised environment? Blockchain networks rely on digital signatures. A digital signature is based on a person’s private key and on the content that is being signed. It is therefore unique to each transaction and any attempt by someone to impersonate another would be detected immediately by the recipient, who would be able to see that the digital signature has been tampered with – unless of course you have access to someone’s private key. Digital signatures therefore allow you to have trust in the identity of the people around you despite the lack of a central authority. And so it looks like G and T might be able to exchange OGEMID brownies undetected by anyone.

In the meantime, our friend Kemi really does like Simi’s new handbag. Kemi spots Titi with the same handbag and so asks Titi if she will sell it to her. Titi agrees, provided the payment is made using cryptocurrencies. Kemi makes the payment. And then Titi says: "Tough. I’ve changed my mind. I now want twice the amount to give you the handbag."

What can Kemi do? Kemi only has an oral contract with Titi. If Kemi had paid in cash, then she and Titi would have exchanged the handbag and the cash at the same time, and so Titi wouldn’t have been able just to pocket the money. But here, they are using cryptocurrency. Let’s say they had written down their agreement, including terms for Bitcoin payment, and included a Lagos Court of Arbitration (“LCA”) arbitration clause. Kemi might start a LCA arbitration, but that will take some time and money to get to a final award, and Kemi might then need to go to the Nigerian courts to obtain specific performance, and that might take years…

What if Kemi and Titi had concluded a smart contract? A smart contract is like a mini piece of software. [17] At its most basic, it takes the structure of ‘if…then…’. If you make this payment, then I’ll give you my handbag. The difference between the written document and the smart contract is that the smart contract is self-executing. In our example, Kemi and Titi would conclude a smart contract for the sale of the handbag. Titi would, for example, place the handbag in a locker with an electronic lock that is unknown to Titi. The smart contract would say that if Titi’s account is credited by a certain date with the agreed Bitcoin amount from Kemi, then the electronic padlock would generate a code given to Kemi only for her to go and retrieve the handbag. Failing this timely payment, the electronic padlock will generate a code given to Titi for Titi to go and take back her handbag. In this manner, Titi no longer has a choice whether or not to handover the handbag. Kemi either paid or didn’t pay, and there’s no room for dispute or third-party intervention.

Well… In our example just now, Titi was honest and put the agreed handbag in the locker. Maybe Kemi and Titi went together to the locker to place the handbag. Now let’s say that Titi went alone and put a different handbag in the locker. The smart contract had only indicated that Titi was selling the handbag in the locker, without describing it further. What can Kemi do? Maybe the smart contract contained an additional term that said, in case of dispute following Kemi’s retrieval of the bag, Kemi can start arbitration proceedings within 10 days. But in any event, this is where the self-executing characteristic of smart contracts reaches its limit.

Returning to our example, Kemi really wants to buy Titi’s evening handbag, and Titi really wants to sell it to Kemi because Titi wants to buy another handbag that has just come out:

Photo by Creative Headline on Unsplash

The problem is that Kemi is a bit short on Bitcoins to be able to afford Titi’s handbag fully, and Titi is a bit short on dollars to be able to walk into the handbag store.

Kemi and Titi are both confident, however, that the value of Bitcoins will increase within the coming month. After all, Bitcoins are becoming increasingly popular. Say we have an online resource that gives you in real-time the value of Bitcoins as against the dollar and can send that information to a blockchain. [18] Kemi and Titi can agree in their smart contract the Bitcoin price of Titi’s handbag, and that the payment from Kemi to Titi will take place automatically if the Bitcoin reaches a certain dollar value by reference to that online resource. The third-party source of information used in the smart contract is known as an oracle.

Now say Titi, to hedge against Bitcoin volatility, creates her own smart contract to say that, if she receives Bitcoins from Kemi, those will be automatically used to purchase dollars. We can see how that works as software, but is it still a contract as we know it? A smart contract is really about the automatic execution of an action if a condition is fulfilled.

For a smart contract to work, every term must be clearly thought through, failing which there may be issues in the execution of the parties’ bargain, which can go beyond the limitations of a written contract. This may in turn give rise to more disputes.

Specificity. We saw this limitation a moment ago: if the obligation says the handbag in the locker, rather than the evening handbag as shown in the attached photo of Titi from last night’s party, then Titi could potentially put any handbag in the locker.

Oracle reliability. If the oracle crashes, the smart contract won’t work as it doesn’t have the ability to go and look for the data elsewhere. Is there any liability of the oracle towards the parties? You could programme your smart contract to refer to several oracles for the same data, so as to mitigate the risk of one of them not being available or one of them giving you incorrect data.

But what if, instead of exchange rates, what you wanted was for the oracle to look up the Nigerian Arbitration and Conciliation Act as currently in force, and it subsequently gets repealed and replaced by a new arbitration law? [18.1]

Conflict of laws. What if Kemi and Titi were of a different nationality, in different parts of the world, and their smart contract didn’t specify a governing law? They would be faced with an extremely complex conflict of laws issue to resolve.

Term/expiry. Let’s imagine Kemi and Titi forgot to put a time-limit or termination provision in their smart contract, and then both got busy with hearings and filings. Now we are next spring, Titi has a party and realises her evening handbag is still in the locker. She can’t do anything about the handbag, which will stay in the locker until such day as the Bitcoin achieves the target dollar value that she and Kemi had agreed upon.

Automation. You have a similar situation if Titi finally decides she wants to gift the handbag to Kemi for her birthday. The smart contract can only perform in one defined manner and, unless the parties provided for the possibility of amending or terminating it, Titi will only be able to give the handbag to Kemi upon receipt of the payment. Bringing this to real life business considerations, a client might at times be willing to accept part performance as full performance, or accept delayed payment without imposing late payment penalties, but this is not possible in a basic smart contract.

Bug. If Kemi and Titi made an error in coding the smart contract, and upon payment the electronic code to the locker was sent to Titi instead of Kemi, what happens then?

Hack. What if, instead of an error about who should get the money, the smart contract had a security bug that made it vulnerable to attack, and someone is able to exploit that bug to get the money sent to them instead of to Titi? [19]

Expertise. [20] To take another example: Kemi gets excited when she sees the Bitcoin reaches the agreed dollar value and goes to the locker to pick up the handbag. She discovers that the handbag is no longer there and her heart sinks at the thought it got stolen. She then checks her account and realises it hasn’t been debited. Now she is very puzzled. She WhatsApps Titi to say that there must be a bug in their smart contract, and Titi responds that it’s all ok, the smart contract provided that, at any time, Titi could take back the handbag from the locker and not receive Kemi’s money. Kemi is infuriated: “You didn’t tell me!” Titi says: “Of course I did! I sent you the coding of the smart contract for your review before we concluded it on the blockchain.” Titi had coding expertise, Kemi did not. The blockchain was meant to remove intermediaries, but do we still need them finally, only different ones? Besides programmers, do we also need to take out insurance for errors in the smart contracts? And in the case of consumer contracts, are these contracts even valid in light of consumer protection legislation against unfair terms, drawing the consumer’s attention to unusual terms, and such?

Contractual terms that cannot be reduced to ‘if...then…’. Relatedly in terms of the continued relevance of us, lawyers: what if, just before placing the handbag in the locker, Titi had a fall and the handbag fell into a muddy puddle? Titi says to herself: “Too bad, I’m running late, I will let Kemi know.” Titi puts the muddy handbag in the locker, forgets to tell Kemi, the smart contract is later executed, Kemi pulls out the handbag, and is upset to see the mud. She cleans the handbag, but the handbag is stained. Did the smart contract contain any warranties? Was there any information or best efforts obligation or obligation of good faith?

As we saw earlier, a smart contract isn’t exactly the same thing as a contract that would be entirely made ‘smart’. In order to limit confusion, terms such as ‘smart agreements’ [21] and ‘smart legal contracts’ [22] have appeared to refer to a normal contract, such as we are used to seeing, but where specific terms are coded as one or several smart contracts. It allows parties to use smart contracts for what they do best, namely self-executing when a condition is fulfilled, while keeping the texture and other terms of a normal agreement. The only thing is that parties may need to specify which instrument would prevail, of the written agreement and the smart contract, in case of discrepancy.

One of the obvious applications of such hybrid contracts is the transfer of real estate. You want title to pass automatically when payment is made, but you also have a number of representations and warranties. A blockchain is well suited to property transactions, because it can provide a definite proof of title.

***

We have covered a lot of ground. What about blockchain, smart contracts and arbitration?

First, it’s the subject of research. There is the Dispute Resolution Working Group of the Accord Project, a New York-based non-profit – Delos is part of the working group; and the Blockchain Arbitration Forum, which appears to be a German association.

Second, there are blockchain-based or related fora. [23] The Polish Court of Conciliation for Blockchains was established in November 2018 as part of the Chamber of Commerce of Blockchain and New Technologies. [24] It is designed to serve as an arbitral institution for blockchain-related disputes. There is also JuryOnline, an initial coin offering (“ICO”) platform (i.e. a platform to raise funds by issuing a new cryptocurrency), Coti, a UK fintech providing cryptocurrency payment solutions, BANKEX, a US fintech looking to develop a tokenisation ecosystem and Confideal, a service to create smart contracts on Ethereum, all of which include a dispute resolution mechanism with their services.

Regarding BANKEX specifically, its dispute resolution mechanism, known as Smart Justice, applies the law of large numbers to crowdsourced decision-makers described as "independent arbitrators" in order to reach a "fair" decision through economically incentivised voting. A similar approach is used by Kleros, a French cooperative started in 2017, which raised the equivalent of USD 2.7m last year in an interactive ICO [24.1] and was also accepted last year into Thomson Reuters’ Incubator. It describes itself as “a decentralized court system allowing arbitration of smart contracts by crowdsourced jurors relying on economics incentives.” In practical terms, anyone can serve as a juror (with specialised pools for specific types of disputes). To do so, you need to bid in the Kleros virtual currency; the higher your bid, the more likely you are to be selected. Once a smart contract dispute arises, it is assigned to a number of jurors. Each one votes anonymously within a set time-limit without their vote being revealed to the other jurors. Once the votes are in, the majority view prevails in deciding the dispute. The jurors in the majority get rewarded with a bonus to their currency holdings. Those who were not in the majority lose some of their virtual currency.

As described by Sophie Nappert and Paul Cohen:

“This is dispute resolution through the wisdom of crowds, with an incentive for the crowds to converge on one viewpoint. It is not arbitration in any sense that we now understand and practice it. But that is the point – and the threat: whatever we may think of the fairness and thoughtfulness of this method of dispute resolution, it has no room for anyone likely to be reading this article.

Today, the type of dispute that a system such as Kleros’s handles is straightforward and usually binary: pay the claimant, don’t pay the claimant. But as with all technology, this initial simplicity is deceptive. There’s nothing technically that prevents greatly more involved decision trees and concomitantly greater numbers of decisions for jurors to make, up to and including the number and range of decisions that arbitrators make in major international disputes.” [25]

Third, blockchain technology may also be relevant to recognition and enforcement proceedings under the New York Convention. For these purposes, one needs to present an original copy of the arbitration agreement and of the final award. If the same were stored on a blockchain, could this facilitate recognition and enforcement proceedings? Arguably yes, as you would have an original copy of both documents, without the need for certification or authentication of signatures – but in legal terms, not necessarily as, unsurprisingly, no mention is made of the blockchain in our favourite treaty from 1958. Therefore, putting aside the idea of a new treaty or amendment to the New York Convention, you would very likely need UNCITRAL to issue recommendations for the interpretation of the New York Convention. [26]

Fourth, smart contracts may also be used for the purposes of rendering self-executing awards. What if, as part of the submission to arbitration, the parties concluded a smart contract that gave the tribunal the possibility to order the payment of damages or costs by one side to the other, and implement that order into the smart contract as if it were an oracle? This might allow for the automatic execution of awards, subject to there being sufficient funds available in the debtor’s electronic wallet.

Interesting… but what about the business reality of cash flow management, budgets spread between different business units while accounts may be centralised, different currency issues, …?

Fifth, blockchain technology is also being used to manage and assess evidence. The Beijing Internet Court thus handled 41 cases between September 2018 and April 2019 involving evidence taken from the blockchain, and 17 more are underway in which the blockchain is being used to collect and submit evidence. [27]

In the same vein, Baidu, in conjunction with the Qingdao Arbitration Commission, “has launched a blockchain solution for legal arbitration. It aims to ensure electronic evidence is trustworthy, accurate, and safe from tampering. The platform also allows for secure storage and transmission of data.” [28]

Finally, the Smart Arbitration & Mediation Blockchain Application (SAMBA), also known as the Miami Blockchain Group, [29] is promoting the use of blockchain technology for the purposes of case management. It has been argued that blockchain is ill-suited for this application and the wrong answer if the concern is cybersecurity in document management; to the extent users wish to use decentralised cloud storage systems in place of Dropbox or Google Drive, such solutions are now available. [30]

***

It has been two years since the intersection of blockchain, smart contracts and arbitration has started entering the mainstream of IA practitioner articles, conferences and conversations. During this time, several jurisdictions have adapted their legislation to recognise and/or courts have ruled in favour of recognising the validity of (certain) blockchain-based evidence and smart contracts (notably China's internet courts; Italy; and Arizona, Delaware, Nevada, Ohio, Tennessee and Vermont, in the US, partly to avoid the pitfalls of hearsay characterisations), [31] others are trialling new blockchain-based evidence systems (notably in the UK), [32] and the first seminal court decisions are being handed down. [33] More change is afoot, including with the development of artificial intelligence (“AI”) and its application through natural language processing (“NLP”), and will be compounded the day quantum computing becomes a commercial reality. Delos is following these changes closely and will soon start a dedicated channel through tech-channel [@] delosdr.org, which you can follow by filling out the short form below:

___

[1] Thanks go to Mihaela Apostol for her research assistance.

[2] On a blockchain, the first block is known as the genesis block.

[3] What follows describes Proof of Work (“PoW”) consensus, which is associated with ‘mining’. These notes do not address (Delegated) Proof of Stake (“DPoS” / “PoS”). which is associated with ‘forging’. You can find out about (Delegated) Proof of Stake at https://lisk.io/academy/blockchain-basics/how-does-blockchain-work/proof-of-stake and https://lisk.io/academy/blockchain-basics/how-does-blockchain-work/delegated-proof-of-stake.

[4] https://lisk.io/academy/blockchain-basics/how-does-blockchain-work/proof-of-stake.

[5] https://lisk.io/academy/blockchain-basics/how-does-blockchain-work/nodes.

[6] Namely Proof of Stake and Delegated Proof of Stake; see note 2 above.

[7] This example is based on an article by Paul Cohen and Sophie Nappert, ROBOTS REDUX: Blockchain, AR and Quantum Computing Explained to Lawyers, Their Impact on the Arbitral Process, and Why The Time To Act Is Now, available at https://www.researchgate.net/publication/335776761_ROBOTS_REDUX_Blockchain_AR_and_Quantum_Computing_Explained_to_Lawyers_Their_Impact_on_the_Arbitral_Process_and_Why_The_Time_To_Act_Is_Now, p. 5. A shorter version of the article dated 3 September 2019 is available at https://globalarbitrationreview.com/article/1196707/robots-redux-blockchain-augmented-reality-quantum-computing-and-the-future-of-arbitration on the Global Arbitration Review (“GAR”).

[8] See, for example, https://www.mathsisfun.com/numbers/prime-factorization-tool.html.

[9] You will need to do this multiplication manually, or otherwise break it down: if you try doing it in Excel, Excel will round the last three digits “021” to “000”, and you can tell the numbers have been rounded in that 9 x 9 will always produce a number ending in “1”.

[10] See, further, note 12 below.

[11] Bitcoin uses the cryptographic hash known as SHA-256. A SHA-256 hash calculator is available at https://www.xorbin.com/tools/sha256-hash-calculator.

[12] This presentation does not address the matter of hard forks when a consensus protocol is changed.

[13] In a P2P network, all nodes are equal, but can take on different roles, such as that of a miner or of a ‘full node’. All nodes/peers provide resources on a voluntary basis, and the resources are provided directly to other nodes/peers without the need for any central coordination by servers or stable hosts.

[14] https://lisk.io/academy/blockchain-basics/how-does-blockchain-work/delegated-proof-of-stake; https://www.investopedia.com/terms/b/blockchain.asp.

[15] This is known as ‘gas’ on the Ethereum (namely the Ether blockchain).

[16] This is also known as asymmetric cryptography, by opposition to symmetric cryptography where both parties use the same key.

[17] Smart contracts were first conceptualised in 1996 by Nick Szabo as analogous to a digital vending machine.

[18] Push technology is integral to oracles, as smart contracts don’t have the ability to pull data from off-chain resources; pushing the data also solves the issue of the data fluctuating and the time involved in replication across sufficient nodes in order to form a consensus.

[18.1] As of the time of writing, a bill for a new Nigerian federal arbitration law was pending before the Nigerian House of Representatives: see the GAP chapter on Nigeria.

[19] This happened in the case of what is known as the 2016 DAO attack (“DAO”: decentralised autonomous organisation, as distinct from “dapp”: decentralised application, another name for smart contracts).

[20] See also Stuart D. Levi, Alex B. Lipton, An Introduction to Smart Contracts and Their Potential and Inherent Limitations, dated 7 May 2018, available at https://www.skadden.com/insights/publications/2018/05/an-introduction-to-smart-contracts.

[21] Charlie Morgan, Will the Commercialisation of Blockchain Technologies Change the Face of Arbitration?, dated 5 March 2018 (Kluwer Arbitration Blog), available at http://arbitrationblog.kluwerarbitration.com/2018/03/05/topic-to-be-confirmed/.

[22] Craig Tevendale and Charlie Morgan, Blockchain And Smart Contracts: Novel Opportunities For Improving Efficiency In Contract Execution And Dispute Resolution, 21 February 2018, available at https://www.herbertsmithfreehills.com/latest-thinking/blockchain-and-smart-contracts-novel-opportunities-for-improving-efficiency-in.

[23] See also Dr Dominik Vock and Dr Jonatan Baier, Blockchain and Dispute Resolution: Current Projects, ASA Conference, 14 September 2018, available at https://www.arbitration-ch.org/asset/890dc327b1c61c89cda5128e4890e20f/Vock,%20Baier-%20Presentation.pdf.

[24] David, The first arbitration court for blockchain in Europe was established in Poland, dated 5 December 2018, available at https://tokeny.pl/en/sad-arbitrazowy-blockchain/.

[24.1] William George, Kleros' IICO Analysis, dated 26 July 2018 (Medium), available at https://medium.com/kleros/kleros-iico-analysis-eedc1ead09b3.

[25] Paul Cohen and Sophie Nappert, ROBOTS REDUX: Blockchain, AR and Quantum Computing Explained to Lawyers, Their Impact on the Arbitral Process, and Why The Time To Act Is Now, available at https://www.researchgate.net/publication/335776761_ROBOTS_REDUX_Blockchain_AR_and_Quantum_Computing_Explained_to_Lawyers_Their_Impact_on_the_Arbitral_Process_and_Why_The_Time_To_Act_Is_Now, p. 7; see also https://globalarbitrationreview.com/article/1196707/robots-redux-blockchain-augmented-reality-quantum-computing-and-the-future-of-arbitration for the version of the article on GAR.

[26] See, further, Marieke R. P. Paulsson, The Blockchain ADR: Bringing International Arbitration to the New Age, dated 9 October 2018 (Kluwer Arbitration Blog), available at http://arbitrationblog.kluwerarbitration.com/2018/10/09/blockchain-adr-bringing-international-arbitration-new-age/.

[27] Ana Alexandre, Chinese Internet Court Employs AI and Blockchain to Render Judgement, dated 25 April 2019, available at https://cointelegraph.com/news/chinese-internet-court-employs-ai-and-blockchain-to-render-judgement; Giesela Ruehl, China's innovative Internet Courts and their use of blockchain backed evidence, dated 28 May 2019, available at http://conflictoflaws.net/2019/chinas-innovative-internet-courts-and-their-use-of-blockchain-backed-evidence/.

[28] Mirando Wood, Baidu launches judicial arbitration blockchain, dated 7 September 2018, available at https://www.ledgerinsights.com/baidu-judicial-arbitration-blockchain/.

[29] Is blockchain the future?, published in GAR dated 14 March 2018, available at https://globalarbitrationreview.com/article/1166627/is-blockchain-the-future.

[30] Ashish Chugh, Why We Don’t Need Blockchain to Manage Cases in International Arbitration, dated 13 May 2018 (Kluwer Arbitration Blog), available at http://arbitrationblog.kluwerarbitration.com/2018/05/13/dont-need-blockchain-manage-cases-international-arbitration/.

[31] See, e.g., Alice Barbet-Massin, Reflections on the legal recognition of blockchain timestamping by the Italian lawmaker, 27 March 2019 (Wolters Kluwer), available at https://www.actualitesdudroit.fr/browse/tech-droit/blockchain/20718/reflections-on-the-legal-recognition-of-blockchain-timestamping-by-the-italian-lawmaker, which discusses the state of the law in China, France, the EU, Italy and the US. See also: re China, Ana Alexandre, Chinese Internet Court Employs AI and Blockchain to Render Judgement, dated 25 April 2019, available at https://cointelegraph.com/news/chinese-internet-court-employs-ai-and-blockchain-to-render-judgement, and Giesela Ruehl, China's innovative Internet Courts and their use of blockchain backed evidence, dated 28 May 2019, available at http://conflictoflaws.net/2019/chinas-innovative-internet-courts-and-their-use-of-blockchain-backed-evidence/; and re the US: Concord Law School, The Admissibility of Blockchain as Digital Evidence, dated 23 April 2019, available at https://www.concordlawschool.edu/blog/news/admissibility-blockchain-digital-evidence/, and Jason Tashea, Some states are allowing people and companies to use blockchain to authenticate documents, dated 1 September 2019 (ABA Journal), available at http://www.abajournal.com/magazine/article/best-evidence.

[32] See, e.g., Shobhit Seth, UK Courts Start Pilot Blockchain Evidence System, dated 27 August 2018, available at https://www.investopedia.com/news/uk-courts-start-pilot-blockchain-evidence-system/.

[33] See, e.g., the decision of the Singapore International Commercial Court, B2C2 Ltd v Quoine Pte Ltd [2019] SGHC(l) 3, available at https://www.sicc.gov.sg/docs/default-source/modules-document/judgments/b2c2-ltd-v-quoine-pte-ltd_a1cd5e6e-288e-44ce-b91d-7b273541b86a_8de9f2e2-478e-46aa-b48f-de469e5390e7.pdf, and commentary by Norton Rose Fulbright, Singapore court’s cryptocurrency decision: Implications for cryptocurrency trading, smart contracts and AI, dated September 2019, available at https://www.nortonrosefulbright.com/en-us/knowledge/publications/6a118f69/singapore-courts-cryptocurrency-decision-implications-for-trading-smart-contracts-and-ai.